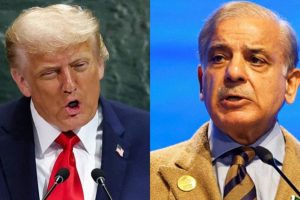

In what is being seen as a setback to former US President Donald Trump, who is seeking a fresh term in the White House in the elections later this year, his media venture, Trump Media & Technology Group, experienced a massive plunge in its stock value, resulting in a staggering USD 1 billion loss in his net worth, CNN reported.

The decline came after the company disclosed dismal financial figures, showcasing losses of over USD 58 million and minimal revenue generation in 2023. Trump’s majority ownership in the company makes him directly impacted by its performance, leading to a substantial drop in his wealth.

Analysts pointed out that the valuation of Trump Media, which has been pegged at multibillion-dollar levels, seems unjustifiable, drawing parallels to the speculative frenzy observed in meme stocks.

The latest regulatory filing from Trump Media revealed a sharp contrast between its financial performance in 2023 and the previous year, CNN reported.

While the company reported a profit of USD 50.5 million in 2022, it incurred a hefty loss of USD 58.2 million in 2023. Revenue figures were equally disappointing, with Trump Media managing to generate just USD 4.1 million, a modest increase from USD 1.5 million in 2022. Moreover, the fourth quarter of 2023 saw a staggering 39 per cent decline in revenue to a mere USD 751,500, raising concerns among investors about the company’s sustainability, especially given its lofty valuation.

Despite the substantial decline in Trump Media’s stock value, which plummeted by 21 per cent on Monday, the shares had still surged nearly 200 per cent since the beginning of the year. Former President Trump holds a significant stake of 78.8 million shares in the company, valued at approximately USD 3.8 billion at Monday’s prices. However, this represents a notable decrease from the peak value of around USD 6.3 billion observed just the week before.

The severity of the losses disclosed by Trump Media has prompted its accountants to express doubts about the company’s ability to continue as a going concern. This warning, reminiscent of a similar caution issued in November, suggests that without significant changes, Trump Media may struggle to stay afloat. However, the completion of a long-awaited merger last week has injected approximately USD 300 million in cash into the company, potentially alleviating some of these concerns. Analysts believe that this cash infusion should provide Trump Media with a much-needed lifeline, enabling it to pay off debts and bolster its infrastructure, according to CNN.

Matthew Kennedy, a senior IPO strategist at Renaissance Capital, said the influx of cash should mitigate the going concern risk, providing Trump Media with a decent runway. However, Michael Ohlrogge, an associate professor at NYU School of Law, cautions that the company’s ability to sustain itself will depend on whether it continues to receive such warnings even after the merger. Ohlrogge emphasises that while the cash raised may offer temporary relief, Trump Media must address its substantial losses to ensure long-term viability.

Despite its financial struggles, Trump Media has been valued by Wall Street as high as $11 billion, although this figure dropped to approximately USD 8.8 billion by Monday afternoon. This valuation is particularly striking given the company’s revenue of USD 4.1 million in 2023, which pales in comparison to its competitors. For instance, X, formerly known as Twitter, reported revenue of USD 665 million in 2013, and over $5 billion in the year before Elon Musk took it private.

The challenges facing Trump Media are exacerbated by the decline in its flagship product, Truth Social. Monthly active users on iOS and Android plummeted by 51 per cent year-over-year in February, reaching just 494,000.

In contrast, X boasts 75 million monthly active users in the US alone. With the 2024 presidential election looming, analysts suggest that Trump Media’s success hinges on its ability to capitalise on digital advertising opportunities, particularly given the support it receives from Trump-backed super PACs.

Trump Media & Technology Group faces significant hurdles as it grapples with financial losses, declining user engagement, and scepticism from investors.

While the completion of a merger has provided a temporary reprieve, the company must address its underlying challenges to secure its long-term viability in an increasingly competitive market, CNN reported.

Trump recently sealed the Democratic nomination for President and will renew his battle with Republican rival Joe Biden for the top office in the country.